Confidentiality

What is a Transaction Team?

Your transaction team consists of your M&A advisor and transaction specialists in business law, accounting, financial planning, and subject matter experts. Kelly can recommend appropriate specialists when you’re selling your business. Kelly does not accept referral fees from subject matter experts, lenders, attorneys, or accountants.

How does my information stay confidential?

Confidentiality is critical in the process of selling your business. Before confidential information is shared, potential buyers sign a confidentiality agreement.

In Kelly’s process, the seller approves each buyer and has an Executed Confidentiality Agreement (CA) in place before Kelly shares confidential information.

Our back office is powered by Deal Relations (DR), a software suite designed for the mergers & acquisitions (M&A) industry. All documents are organized and shared with the seller’s and buyer’s transaction teams through our data room. Sensitive information is not sent by email. As an additional layer of security, tax returns and other documents that may contain social security numbers are password protected.

Highly desirable businesses are relatively easy to keep confidential as compared to businesses that are more difficult to find buyers for. The process of seeking buyers for businesses that are small, in an undesirable industry, in a remote location, or underperforming, is often more difficult to keep confidential. This is because the likely buyer is within 20 miles of the business’ location, and as such, the executive summary that is seen before a confidentiality agreement is in place, must provide greater levels of detail to generate genuine interest.

Kelly is happy to provide a sample of a confidentiality agreement upon request.

Who should I talk to about the sale of my business?

Discussion of your business’ sale should be very limited.

- Transaction Team: a small well-qualified group including your M&A advisor, board of advisors, M&A attorney, attorney, accountant, and subject matter experts.

- If you have a key employee that you feel needs to be informed about the process, consider a “stay bonus agreement” wherein the employee receives a bonus when the business is sold, and a second bonus six to twelve months later if they remain with the company.

- If you’re married, it’s a good idea to keep your spouse apprised of your progress.

While friends who have sold their businesses can be a good source of insight, they can also cause problems providing you advice that is not in the correct context and they may discuss your sale with others. Employees are often the most concerned during this process as they are concerned about their futures and have difficulty with how long the process takes.

Valuation

What is a buyer actually buying when I sell?

Buyers are seeking opportunities to purchase cash flow, in other words, EDITDA. Your products and services are the buyer’s means of growing EBITDA over time. They are buying your company’s assets in the form of intellectual property, brand(s), management team, products, processes, customers, supply chain, inventory, equipment, goodwill, and other tangible and intangible elements of your business. And, in most cases, your buyer will want all of your employees to continue working for the new owner.

What is the value of my business?

The first step in the selling process is obtaining an Estimate of Value (EOV) from a qualified Mergers & Acquisitions Advisor who can recast your financial records, advise you on the market for selling, make recommendations on how to increase value, and provide education regarding the process of selling your business. Additionally, you will learn if you like working with your potential advisor who may be helping you plan and execute the sale of your business.

What is the value of multiple offers for your business?

The biggest benefit of multiple offers is they help sellers make decisions. Second, multiple offers drive up the value of your business. And third, they allow your advisor to negotiate more favorable terms, like the flexibility of the owner’s role during the transition.

Kelly’s provides a comprehensive process, focused upon efficiently bringing out multiple offers at the same time. In this process, Kelly asks you a lot of questions, and you will be asking the buyers a lot of questions. Kelly does the heavy lifting for you, which allows you to focus on the top 3-5 buyers. Kelly brings you through a process to choose between the two that you believe are the best fit.

This process is great for businesses that everyone wants to buy, but what about businesses without multiple offers? In these situations, it is more challenging to educate the seller through the eyes of the buyer. Sellers may believe that they know the value of their business, but there’s no substitute for qualified buyers educating sellers. Qualified buyers help sellers understand the true value of their business in the current market.

The Leverage and Luxury of Multiple Offers

Are you thinking about selling your business to an employee?

If you have an employee or employees that are interested in buying, that is likely the best way to maintain the culture of your business. If they are truly qualified to run your business, they may have a good chance of being successful long term. While family and an employee are my personal two favorite buyer types, such a sale can result in the seller needing to be involved for a longer period of time and the business selling for less than if it could be sold on the open market.

If an employee approaches you when your company is being marketed through an M&A firm, the best practice is to introduce them to your M&A advisor. If using Kelly, Kelly will have them sign a Confidentiality Agreement and vet them to help you understand if they are able to access the funds needed to buy the business “prior to them being given access to more confidential information.”

What should you do when someone asks to buy your business?

It happens all the time; someone asks about buying your business. Most business owners are ill-prepared to handle this question. As a result, they miss out on a golden opportunity to sell. In contrast, business owners equipped with solid answers can better respond to buyers’ questions. If the circumstances are right, the buyer and seller agree to a mutually beneficial transaction.

Market

How is the market for selling?

The post COVID-19 mergers & acquisitions market for high-performing businesses is good. Banks are relatively aggressive. Companies making strategic acquisitions are moving quickly. Private Equity Groups have $3 trillion of committed capital creating a seller’s market for high-performing companies. And there are very good incentives from the SBA right now for businesses and individuals to make acquisitions.

For more details regarding the mergers & acquisitions market, click to download the IBBA and M&A Source Market Pulse Survey or for past Market Pulse Survey’s please click here.

Top Considerations

What is Required Networking Capital and what do I need to know about it?

If you think of your business as a car, Required Net Working Capital is the gas that is expected to be in the tank when you sell. When closing the sale of your business, the purchase price will be adjusted up or down for Required Net Working Capital.

What are realistic expectations to have when selling my business?

Is my business worth what I think it is? Will there be enough money to exit? How much risk will I have after the sale is complete? How long will it take to sell? What type of buyer will I accept? Will the buyer treat my company as I have? The answers to these questions are different for every owner. To help you answer these questions, Kelly Business Advisors offers a complimentary meeting followed by an Estimate of Value (EOV).

Top tips when selling a business?

- “Keep your foot on the gas!” Continue to increase EBITDA until you have been paid for your business.

- Delegate as much of your work as possible to your management team.

- Create a plan for your buyer outlining how you would grow the business in the years to come.

What are realistic expectations to have when selling my business?

Selling a business is a stressful event. Selling involves a lot of moving parts, and each part needs to fall into place in order for a successful transaction to occur. Business owners do themselves a favor by maintaining realistic expectations for the selling process. When setting financial expectations for a business sale, here are a couple of key points for sellers to remember:

- First, the market will not pay more than a business is worth, so have a third-party expert help you understand the value and market for your business.

- Second, different buyer types will place a different value on the same business.

What is the most important part of your equipment value?

Businesses Kelly typically works with sell for more than the combined current value of their accounts receivable, inventory, equipment, and real estate if included. And while business owners often hope their equipment is worth more than it is, and may even convince a buyer of the same, the value of your business is not in its physical assets. It’s in the value generated as a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). If the value of equipment sold is above its book value, that gain is taxed as ordinary income verses at a lower capital gains level for goodwill. It is in the buyer’s best interest to negotiate a higher value for your equipment, and for the seller to have the value as low as possible. If a buyer and seller cannot agree on the value of the equipment, ordering a third-party equipment valuation may be required.

Preparation

Am I ready to sell my business?

The best time to sell your business is when your profitability, sustainable growth, and management team are all performing at a high level. However, retirement and burnout are the top two reasons people decide to sell their business. If any of these situations describe you, it may be time to consider selling, family succession, or transitioning out of the ownership role.

What can I do to increase the value of my business?

While businesses are unique, good business practices are fairly universal. If you are considering a three to five year approach to increasing your business’ value, it is best to work with an exit planning specialist. If a one year program is more aligned with your desired timeline, the Kelly Value Enhancement Program (VEP) may increase your potential sale price by over 20%.

How to choose a Mergers and Acquisitions Advisor?

You’ve decided to sell your business, and now it’s time to find a Mergers and Acquisitions Advisor1 who can help you navigate the whirlwind that’s on the horizon. Going it alone or choosing the wrong advisor can prove to be a frustrating experience. On the other hand, hiring the right M&A Advisor will be one of the smartest business decisions you’ll ever make.

For more information about choosing an M&A advisor, read the Eight Things to Consider When Selecting an M&A Advisor.

Is my business ready to sell?

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) is the number one value driver of your business. The more sustainable the future of your companies EBITDA is, the more ready it is to sell. When you think about the word sustainable, that would mean how sustainable the business is with a new owner.

Process

What is the process for selling?

The selling process begins with understanding your business’ value, net proceeds, and the market. Prepare to market your business for sale while maintaining confidentiality. Present your business to potential buyers in a manner that will receive the highest value. Finesse and negotiate an Indication of Interest and/or Letter of Intent. Work though Due Diligence and plan for post-closing transition.

What is the process for buying?

Many excellent businesses are sold without ever being advertised. Kelly offers a complimentary meeting to brainstorm ideas and help you understand the attributes to look for in a potential acquisition. From initial advising to closing, Kelly is the M&A advisor who will help you every step of the way.

How does Kelly Business Advisors Market your business?

Often, to create an auction-like environment, buyers that have the ability to move faster are not contacted until other interested buyers have expressed an interest in the company. Ideally, there is enough interest in your company from multiple buyers that allows Kelly to set a deadline for Indications of Interest (IOI’s), creating a sense of urgency with your buyers. Having multiple buyers typically drives value up, educates our clients on important deal terms, and helps them make a decision on which buyer they want to sell their business to.

Each client has a customized marketing plan utilizing combinations of three primary marketing channels.

- Email, snail mail, and phone calls to the following.

- Targeted Buyers List. This is a comprehensive list created by you and your Kelly Advisor to include prospective buyers that may have contacted you in the past, companies our research show to have positive synergies with your own, and private equity groups with experience and/or desire to own companies in industry. The seller will always approve who we market your business to. If needed, we also create a “do not call” list for people or companies that you do not want us to contact.

- Registered Buyers List. This list contains individuals and companies that have expressed an interest in businesses that Kelly has previously marketed for sale and buyers reaching out to us looking to buy a business.

- Centers of Influence (COI’s). In Northeast Wisconsin, we have a pool of roughly 3,000 business professionals including accountants, attorneys, bankers, and financial advisors to whom we market businesses for sale. When we are selling a business outside of that area, we will use a list service to obtain email addresses for similar professionals within a 50-mile radius of the seller’s target market area.

- Internet Advertising. We utilize several mergers and acquisitions websites to market businesses we are selling. The websites used will depend on the business’ size, location, profitability, desirability, industry, and buyer types that we are targeting.

- Social Media. Kelly uses LinkedIn and Facebook from time to time to market businesses that are more challenging to find buyers for.

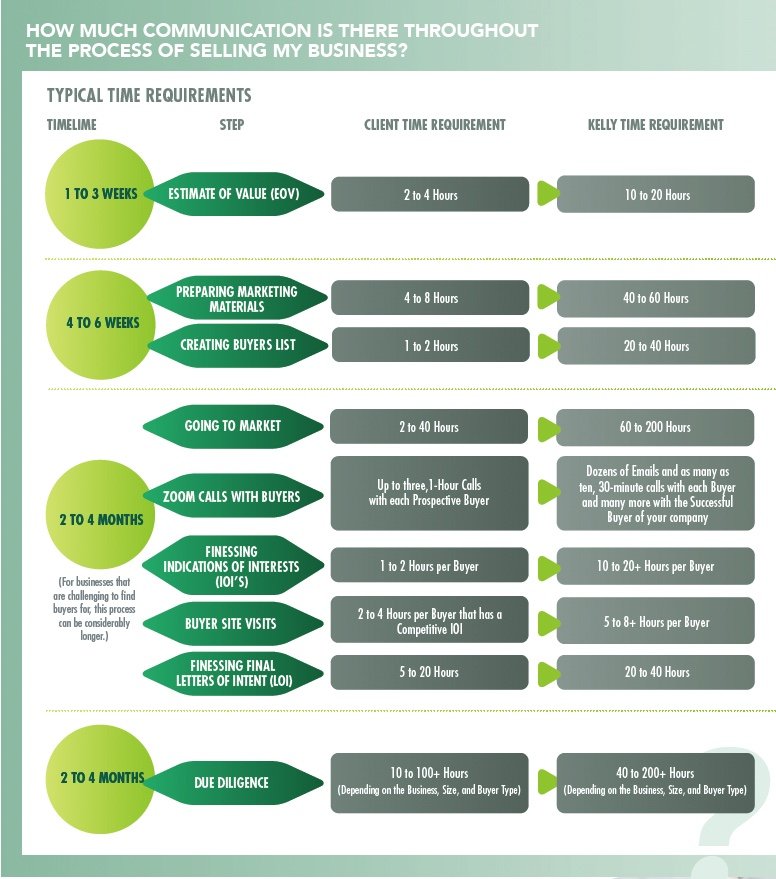

How much communication is there throughout the process of selling my business?

Communication will vary throughout the sale process. Your Kelly M&A advisor will be part of every call with potential buyers, from initial calls to closing. And with your personal login to the Kelly portal, you’ll have access to all critical documents, targeted buyers list, buyers’ confidentiality agreements, notes from calls with potential buyers, and our schedule of ongoing calls and meetings…all in real time.

Early in the process, communication is flexible and easily managed through our portal login and weekly calls with your advisor. As the process continues, it will require more involvement from you has Kelly has more buyers with increased interest in your company. As we work toward the final LOI, you may be called upon almost daily to address details of the transaction. Time required after the final LOI is completed will likely depend on the level of detail you provided throughout the process. At every stage in the process, our ability to proceed quickly depends on your timely response.

Who Are The Buyers?

What type of buyers would be interested in your business?

There are many buyer types that may be interested in your business. Your business’ industry, sales channels, products, services, level of EBITDA, size, management team, and location determine what type of buyers would be interested in buying your business. When going to market, it is best to go after several buyer types to find a buyer that may be a good fit with an attractive value.

What is the “second bite of the apple”?

The two primary acquisition types for a private equity group (PEG) are purchasing your company as a “platform” which they will build from, or as an “add on” to an existing company they own. When selling your company as a platform, you will likely be required to roll equity, typically 10% to 30%, into the new company and continue to run the company for a couple of years. If your company is acquired as an “add on,” you may have the opportunity to roll equity into the new company, and your role in the company could be less, if that is what you are looking for.

Due Diligence

What to be prepared for in due diligence?

When selling your business, due diligence is a critical phase where the buyer thoroughly examines various aspects of your business to ensure everything is in order. This period of time is also a time for the seller to continue their due diligence on the buyer of the business. The sooner a seller is prepared for this step, the better. Kelly strives to help you be prepared for due diligence every step of the way.

Click below for a list of the top 10 areas to be prepared for.